12nd, July 2021

If companies were in a rush to implement digital transformation pre-Covid, they are now in a race. Based on their recent survey McKinsey reports “Covid has pushed companies over the technology tipping point,” with executives responding that their companies “have accelerated the digitization of their customer and supply-chain interactions and of their internal operations by three to four years.” That is what we call tech transformation in hyper-drive, the equivalent of light speed.

Finance department leadership including the CFOs must be ready. Technology is a great tool to provide better leadership, strategy, performance, analytics, controls, reporting and operations management. But the tech revolution that is transforming business is not just about technology. It is about the humans behind the technology, and their ability to leverage these new and exciting tools in ways that add value to the business. This means a major upskilling initiative is underway in finance and accounting to understand the technologies and learn how they fit into processes like the financial close or forecasting

So, what are the technologies on which they should be focusing their attention? We think it is useful to share some thoughts on what has now emerged on the “must have” list of CFOs and finance leaders.

Automation:

Advanced Data Analytics:

Cloud-based Computing:

Blockchain:

Though these technologies require new skills, for many in finance and accounting, the efficiencies they can bring are a welcome change. The “before hours” and “after hours” meetings, where different units reconcile financials to provide accurate numbers for management to report, can become a thing of the past, with the aid of blockchain technology. Advanced data technology can capture ever-increasing amounts and types of data, providing clearer pictures to CFOs about the state of the business. Smart contracts have eliminated the need for in-person handshakes as a sign of trust because every item in the contract can be validated digitally.

But these technologies will not implement themselves; finance must make the case for their implementation. Technology is a long-term investment, which may be competing with demands from other departments or from shareholders who seek higher short-term profits and dividends. Finance department’s role has shifted from a pure back office bookkeeper to being a business partner. As a strategist and business partner, the finance professional’s most important role post-Covid will be technology enabler. Finance and accounting professionals must become the proverbial cheerleaders for these break-through technologies.

Today’s crisis mode will soon give way to a new normal, where growing in a highly competitive market will be the mandate. Technology is speeding up our world and the way we do business, but it is still just a tool, most useful when it is in the right hands.

Finance leaders and CFOs are posed the critical question on how do we transform ourselves to be an effective and critical partners to the business by shifting our core activities from the “back office” book keeping to the “front office” role. We need to be the co-pilots of the business. In today’s dynamic environment – where technology advances are driving business model changes, regulatory frameworks are imposing significant burdens, and the pace of change is accelerating – it is imperative that finance and accounting functions leapfrog from keepers of historical records to strategic decision support and operating model enablers.

Finance and Accounting are not just a simple or monolithic function. We can categorize the key sub-functions of finance and accounting as follows:

Finance as a Strategic Enabling Function:

Finance as a Back-Office Service Provider:

Finance as a Business Enabler:

Finance as a Control Function:

To embark on the process of building a finance and accounting transformation roadmap, it is essential that the CFO and his/her compatriots realize and acknowledge the need for transformation. It is important for the top management to distinguish ongoing operational and process improvements from the fundamental need to rethink. A reimagination of the operating model, the re-engineering of core processes, and the major re-architecting of the systems are when a finance and accounting transformation roadmap is warranted.

Faced with the dilemma on the need to drive transformation and adaption of technology to navigate the function to the “front office” role, Finance roles must be prioritised and certain critical decisions have to made. During the current crisis mode and in the “new normal” that we will need to embrace, finance leaders are faced with the question on where do they prioritise based on optimised organization structure. One option that more and more finance leaders are considering as part of the new normal is outsourcing the back office function to external professional partners while they embrace the digital transformation move on to the role of the critical co-pilots for the business.

At Catalyst Myanmar Co Ltd (“CMCL”) we fully embrace the challenges faced by the finance leaders of today and understand their struggle in managing their accounting / bookkeeping “back office” functions. The finance leaders are at a crossroad and we are prepared to assist them in making the right choice to prepare for the new normal – the business co-pilot. If you are interested in reviewing what we can do for your company, please contact us for a free consultation.

30th, June 2021

With the ever changing business conditions, outsourcing of accounting / bookkeeping function is being seriously considered by many organizations.

Nowadays, business owners face the weighty expectation of meeting the challenges in a COVID19 pandemic era, delivering financial transparency and meeting the requirements of financial institutions & government / regulatory compliance. Leaving entrepreneurs in a daily juggle of responsibilities of time-consuming tasks such as finance, accounting, bookkeeping, compliance, internal audit and risk management. Most business owners are caught in the struggle of trying to do more with fewer resources available to them.

One can only manage with the “bench strength” available within the organization and in the talent pool in the country. This is why many companies, small, medium and large, are turning to outsourcing as their preferred solution. In fact, accounting / bookkeeping is one of the main outsourced functions in the business world!

Business owners are realising that outsourcing provides an opportunity to receive quality accounting service from professionals without the added costs associated with an internal accounts department.

Here are some of the main advantages of outsourcing of the accounting / bookkeeping function:

Accounting professionals are masters at what they do. They get the job done right and in the most cost-effective way.

By outsourcing to a firm, you can be at ease that the most qualified individuals are handling your accounting / bookkeeping. Outsourcing gives you the benefit of having a team of objective and unbiased professionals advising you on financial matters, helping business owners avoid making emotional decisions.

Accounting professionals are up to date on the latest industry requirements, regulations and internationally recognised accounting standards. They monitor relevant laws and regulations to stay on top of critical developments and processes. Outsourcing to an accounting professional gives you the assurance and peace of mind that the accounting tasks are done correctly.

The Outsourcing Firm will also be able to provide advisory services on Internal Audit to review the organizations Internal Audit setup and help to setup one for the company or alternatively undertake the function for the organization and advice on internal audit matters.

With outsourcing, you only pay for the services you need when you need them.

You can choose full outsourcing or a specialised resource enhancement package to help overcome temporary staff shortages. You have the benefit of being able to upsize or downsize your accounting needs without dealing with the internal challenges, such as unemployment claims, furlough decisions, severance packages. You also won’t have to worry about allocating time and resources to recruiting and training new employees. So you save on accounting cost and HR cost when you decide to outsource.

Having a qualified team to handle your books means that you can focus on developing important areas of your business. Having peace of mind that your financial responsibilities will be completed on time. Furthermore, you have the advantage of having powerful analytics available to you, helping you understand budgeting and performance factors.

Any suspicious activity found is immediately reported, which results in reducing fraud and regulatory penalties.

Finding an outsourcing provider that you trust and can build a good working relationship with is the first step. Outsourcing will free up large amounts of valuable time, allowing for a better distribution of workload and management.

Outsourcing Accounting firms provide a wide range of services such as treasury and cash management, capital optimisation, credit facility analysis, debt compliance monitoring, cash flow preparation in additional to the run-of-the-mill accounting / bookkeeping services. Having these services available to you frees up valuable time to delegate and focus on the growth of your business.

28th, June 2021

Many organizations do not appreciate the importance of an Internal Audit (“IA”) function within their setup. The value of IA and the benefits it provides may not always be readily apparent to those undergoing an audit or to organizational decision makers. This varying perception of contributed value has led to a disparity in understanding the critical nature of a IA function with the organizations, further complicating the role of this critical function.

Some organizations have started to established an IA function, but they struggle to fully understand and comprehend the role of IA and the governance structure. There are also others who choose to outsource the IA function. Still others perform periodic IA projects on an ad-hoc basis – generally in response to specific risks or negative events that have occurred.

While IA may not have always been perceived as adding value to organizations beyond checking a regulatory box, it can play a vital role in overall operational enhancement. IA has become an important component of proactive, forward-thinking organizations that strive for continuous process improvement while seeking to reduce organizational risk.

IA’s role in an organization is to provide an independent assessment of the processes and controls under audit and provide recommendations for enhancement. Value is realized when the benefits of those recommendations exceed the costs or efforts of their implementation.

Examples of areas where value is added either directly or indirectly as a result of IA include:

In order to provide the greatest value to an organization, IA seeks to make the most significant, high impact, high quality, practical recommendations that can reduce risk, improve operations, decrease costs, and increase profits.

At Catalyst Myanmar Co Ltd (“CMCL”) we understand the struggle of local organisations in establishing and running an effective IA function and as such, we are here to assist you by providing an outsourced IA engagement. Why outsourced IA function? Below are some benefits for consideration;

If you are interested in reviewing what we can do for your company, please contact us for a free consultation.

17th, September 2020

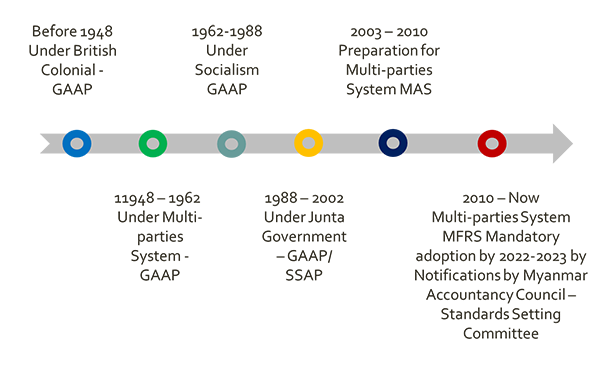

Domestic public companies are required to use Myanmar Financial Reporting Standards (MFRS), which are identical to the 2010 versions of IFRS Standards. In July 2018, the MAC announced the adoption of the latest versions of IFRS Standards for financial reporting periods beginning in or after the 2022–2023 financial year. Early adoption of IFRS Standards is permitted.

With support from ADB, MICPA Board is actively working on translation of IFRSs for SMEs as first priority, which is targeted to complete by Dec-2020.

Ref: AFA-ISCA-IFRS FRC Conference, Nov 2019, MICPA

Catalyst Myanmar is happy to assist you to begin IFRS journey. Please feel free to contact us at siva.prakash@catalystmyanmar.com.com; chochothet@catalystmyanmar.com.mm; nwayyunaing@catalystmyanmar.com.mm; maymyatcho@catalystmyanmar.com.mm